At the Research Center at World Business Chicago, we’re tracking macro indicators for the U.S. economy and how they could impact the region closely.

Big picture:

- Although the economy has moderated amidst signs of strain, the outlook is uncertain. The uncertainty is what’s causing economic activity to slow down, as businesses pause major capital investments and reevaluate their financial positions.

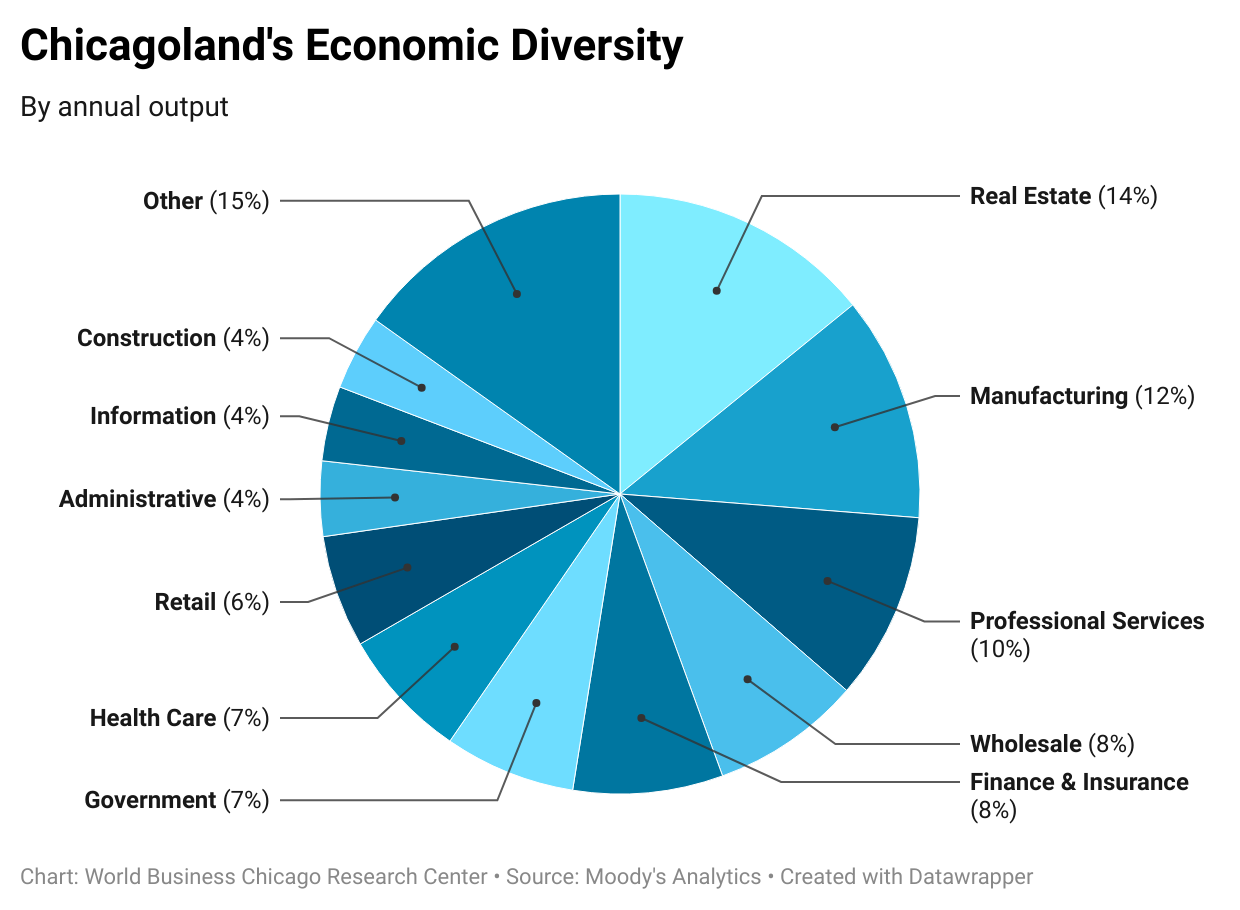

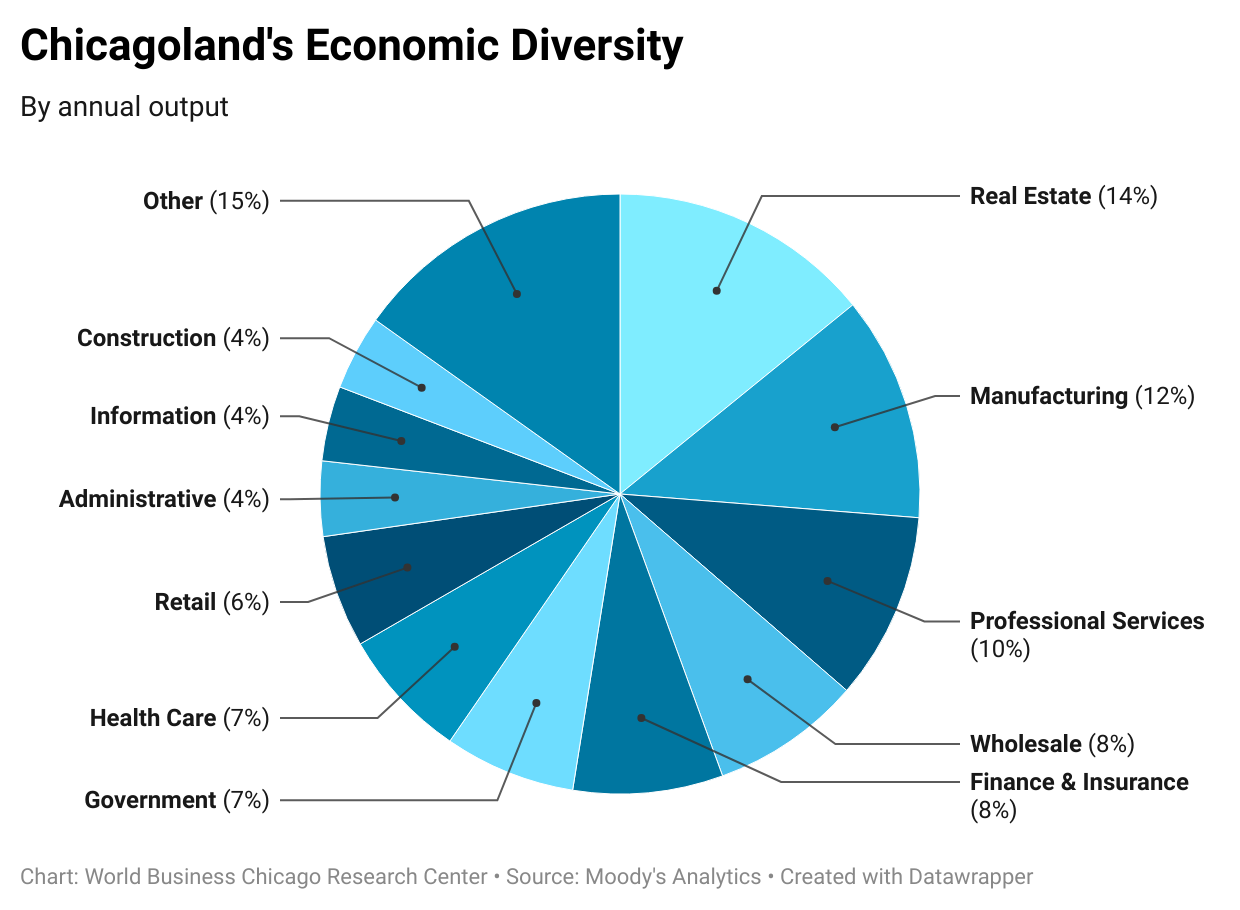

- We see mixed signs in Chicagoland. The region is often a bellwether for consumer spending and sentiments, and our robust manufacturing and logistics industries have considerable exposure to trade uncertainty. However, our economic diversity and momentum is a leading factor for our resilience.

Leading economists are all pointing towards an economic downturn, and business leaders are not optimistic about the economy:

- Economists at Moody’s Analytics now place the probability of a U.S. recession in the next year at about 48%, noting this is the highest such probability seen without an actual recession following soon after.

- The New York Federal Reserve and JPMorgan estimate the probability of a recession within 12 months at around 29% and 40% respectively, with Goldman Sachs putting the odds at 30%.

- JPMorgan’s midyear Business Leaders Outlook Pulse survey shows optimism about the national economy has fallen by more than half, dropping from 65% to 32% in June. Optimism about the global economy has also dropped by half, from 29% to 15%, and optimism about local economies fell to 35%—a 24 percentage point decrease.

Why? Leading risk factors:

- Inflation & stagflation: Inflation has eased, but remains higher than historical norms and stagflation – inflation coupled with stagnant economic growth – is a concern. Consumer purchasing power is reduced, increasing pressure on companies to absorb cost hikes.

- Tariffs & trade policy volatility: Aggressive U.S. tariff policies and global trade tensions have led to unpredictable input costs and disrupted supply chains.

- High operating costs: Businesses across sectors face elevated costs for labor, materials, and energy, squeezing margins. Costs can delay investments like technology and equipment upgrades, which may further hamper competitiveness in the long run.

- Consumer confidence & spending: Consumer confidence saw sharp declines earlier this year, and although there was some recovery, the overall mood remains cautious. Lower household spending directly impacts business revenues and raises concerns about future growth prospects.

- Debt & financial risks: Elevated levels of corporate and government debt, combined with higher interest rates, create risk of financial instability. A crisis in any major market could cascade globally, with impacts on stock prices, exchange rates, and supply chains.

But there’s optimism in data and sentiments:

- In Q2 2025, the U.S. saw a 3.8% growth in real GDP from the prior quarter, compared to a contraction of 0.6% in Q1 (a recession is two or more consecutive quarters of GDP contraction.)

- In the same JPMorgan survey above, 58% of executives were still optimistic about their own companies: 78% expect revenue and sales to increase or remain the same, and 72% expect profits to increase or remain the same

Chicagoland’s economic picture is also mixed:

- Inflation is up, but not by a lot. Chicagoland’s Consumer Price Index (CPI), a measure of inflation, was 3.1% higher in August 2025 compared to 12 months ago, an increase of 0.6 percentage points from the prior month. For comparison, the U.S. CPI is 2.9% higher than last year. And for reference, the Federal Reserve’s targeted inflation rate is 2.0%. Inflation may feel higher because salient prices for consumers are actually higher: the food index rose 0.7 percentage points, where meats, poultry, fish, and eggs are 5.6% more expensive than a year ago.

- Chicagoland’s employment situation is up compared to 2024, but slowly declining throughout 2025. From July 2024 to 2025, employment increased 26,800 people and unemployment decreased 50,174 people – a positive picture, but indicative of the fact that over 58,000 people left the labor force. Between June and June 2025, employment decreased by 21,000 people, the labor force decreased over 10,600 people, and there are over 9,500 more unemployed people.

- Chicagoland continues to have projected GDP growth. Moody’s Analytics projections demonstrate a $920 billion economy for Chicagoland as of Q3 2025, up 1.0% from Q2.

- Exports moving through O’Hare remain up, although Illinois exports and freight are down. Export value through O’Hare International Airport through July 2025 was $52.5 billion, a 17.2% increase from YTD 2024. However, according to the Cass Freight Index, national freight shipments and expenditures are down 9.4% in August 2025 compared to last year, and exports originating from Illinois are down 1.2% compared to YTD last year.

- Businesses expect clarity soon. In the August 2025 Chicago Business Barometer survey, a majority (31%) of businesses expected to have clarity on input costs in the next three to six months.

Although we don’t know where the economy is going, Chicagoland has a few advantages. The region’s economy is incredibly diverse: no industry makes up more than 14% of the total mix. This creates insulation from major industry shifts: for example, amidst tech and government layoffs throughout the past year, Chicagoland’s employment still grew over 2024. Our position as the #1 destination for corporate relocations and expansions puts us on the forefront of business activity that continues to happen, in large part because businesses can continue to find a dense base of customers and affordable inputs here.

→ Follow the WBC Research Center for up-to-date indicators on the Chicagoland economy, including our monthly Economic Dashboard.